extended child tax credit dates

The legislation made the existing 2000. If you havent yet filed your tax return you still have time to file to get your full Child Tax Credit.

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

While the IRS did extend the 2020.

. The IRS and Department of Treasury announced that the expanded credit will begin being paid out as advanced monthly payments starting July 15 to. Not a tax deduction Half of the credit can be paid in advance between July 2021 to December 2021. For children under 6 the amount jumped to 3600.

On July 15 Biden explained his conception of the credit as both a middle-class tax cut and the largest-ever one-year decrease in child poverty in the history of the United States. Meanwhile the Internal Revenue Service IRS says it will need time to resume child tax credit payments when the time comes. Under Bidens plan qualifying households would get a credit of 3000 a year for every child aged between six and 17 and 3600 for every child under six.

As part of the American Rescue Act signed into law by President Joe Biden in March of. For instance House Democrats came up with a proposal to keep the increased benefit going until 2025. But others are still pushing for the credit to be extended to 2025.

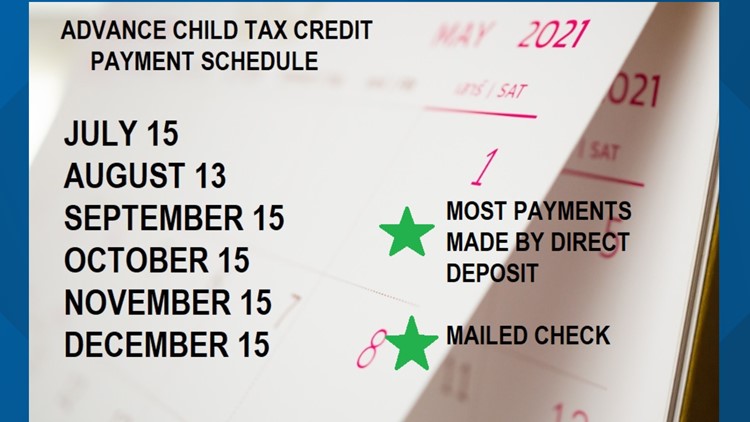

Previously the credit was 2000 per child under 17 and. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The tax credit is expanded to include ad.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The American Rescue Plan expanded the child tax credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17.

Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th. The IRS sent the last child tax credit payment. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

The Child Tax Credit was significantly expanded in 2021 by the American Rescue Plan so families could receive up to 3600 per child under 6 and 3000 for those ages 6 to 17. Visit ChildTaxCreditgov for details. 13 opt out by Aug.

15 opt out by Aug. Families who normally arent required to file an income tax return should use this. Date of Payment Details.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. Theres Still Time to Get the Child Tax Credit.

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

/cloudfront-us-east-1.images.arcpublishing.com/gray/KNUKXEQVVFHXFCIDCNVOW7SL5M.jpg)

First Phase Ending For Child Tax Credit A Game Changer For Families

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Will Monthly Child Tax Credit Be Extended Into 2022 Motherly

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Nearly Half Of Eligible N J Families Haven T Filed For Benefits As Deadline Looms Nj Com

How Many Child Tax Credit Payments Remain For 2021 As Usa

Biden Low Income Tax Proposal Follows Path To Becoming Permanent

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Improvements Must Come Before Corporate Tax Breaks Center For American Progress

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Last Day To Unenroll In July Advanced Child Tax Credit Payment

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget